Women in Senior Management deliver better Bottom Line results

Companies with higher female participation at Board level or in top management exhibit higher returns, higher valuations and higher payout ratios, according to a report by Credit Suisse Research Institute.

London. According to a report released today by Credit Suisse Research Institute, ‘The CS Gender 3000: Women in Senior Management’, companies with higher female participation at board level or in top management exhibit higher returns, higher valuations and higher payout ratios.

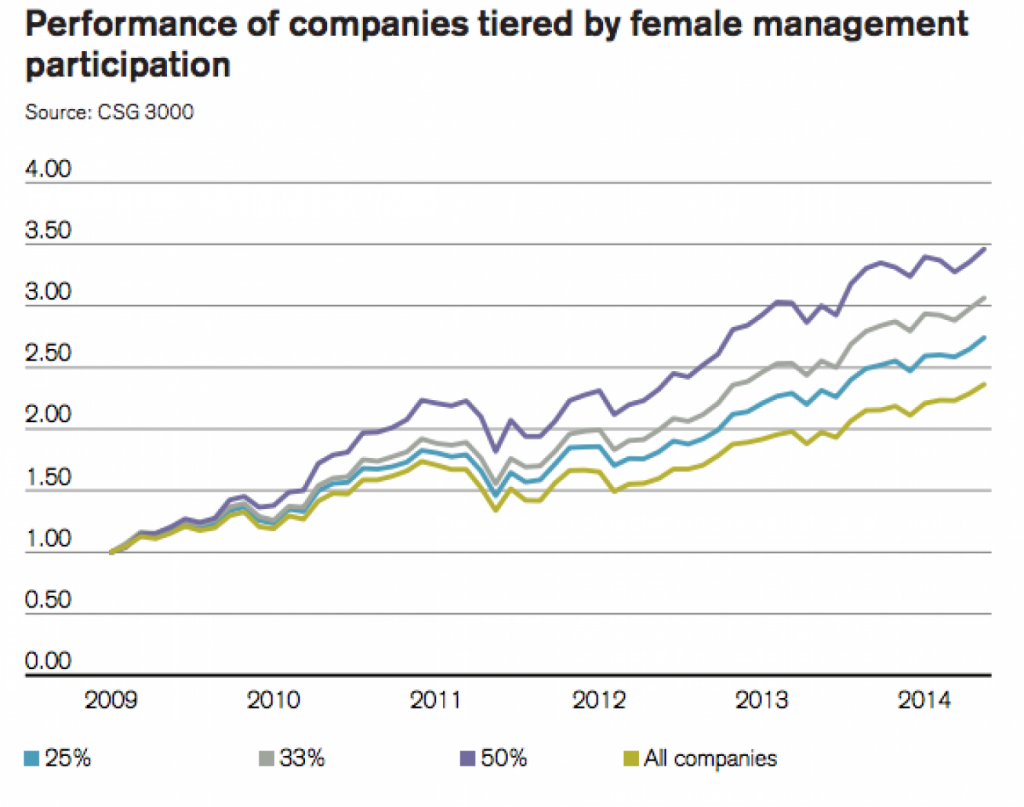

The report introduces ‘The Credit Suisse Gender 3,000’ (CSG 3000), a proprietary database from Credit Suisse global research coverage, encompassing over 3,000 companies and 28,000 senior managers across 40 countries and all major sectors. The aim of the CSG 3,000 is to track the gender mix amongst key senior management roles across company, industry and country lines with the aim of assessing if diverse board structures are mirrored in diverse senior management teams.

Highlights include:

- Board diversity having increased in almost every country and every sector, progressing from 9.6% in 2010 to nearly 12.7% at the end of 2013.

- Female participation in top-management (CEO and directors reporting to the CEO) stands at 12.9% at the end of 2013. Just 4% of CEOs in the CSG 3,000 are female.

- Share price outperformance has been sustained: Since the start of 2012, there has been a 5% outperformance on a sector neutral basis by those companies with at least one woman on the board. A longer trend analysis shows a compound annual excess return since 2005 of 3.7%.

- The findings show that while the representation of women in management positions and on the boards of companies is similar, it is qualitatively different in its makeup. The report maps the “Management Power Line” showing how women in management are concentrated in shared services and staff functions and while differences exist between sectors and countries. The report argues that these roles tend to reflect less influential positions in the management structure.

“It’s been two years since we published the Gender Diversity and Corporate Performance report and there has been a lot of evidence to corroborate our original findings of the striking correlation between diversity at the board level and improved corporate financial performance,” said Stefano Natella, Global Head of Equity Research. “We wanted to take this opportunity to revisit our arguments to see if they hold true in a post-crisis world and to consider what happens below the boardroom to assess whether diverse boards reflect diverse top management positions.”

The report evaluates the average financial metrics of companies, with the following key findings:

- Higher return on equity (ROE): Since 2005, the average sector-adjusted ROE of companies with at least one female member since 2005 has been 14.1% compared to 11.2% for those with zero representation. When looking at top management and adjusting for any industry bias, companies with more than 15% of women in top management have a 2013 ROE of 14.7% compared to 9.7% for those where women represent less than 10% of the top management, a premium of 52%.

- Higher price/book value (P/BV) multiples: In line with higher average ROEs since 2005, the report finds an average P/BV of 2.3x for boards with female representation and 1.8x for those without. At senior management level, companies with more than 15% women in management show a 2013 P/BV of 2.6x vs 2.0x where women represent less than 10%, a 33% higher valuation.

- Higher payout ratio: Companies that have at least one woman on the Board of Directors have seen an average payout ratio of 38% since 2005 vs 32% at companies with no female directors. Similarly, at companies with more than 15% of women in top management, the 2013 payout ratio was 43% versus 36% for companies with less than 10% female management participation, a 22% higher payout.

- There is less convincing evidence than in our previous findings that women run more conservative business models: Companies with less than 10% of women in top management showed at the end of 2013 a net debt to equity ratio of 35% versus 57% for companies with more than 15% of women in top management. There is no difference though when we look at board representation: average data since 2005 show that net debt/equity where there is female board representation has been 47.7% compared to 47.5% for male only boards.

The report further highlights that although the proportion of women in senior management is similar to that in the boardroom, their roles are arguably focused on areas of less influence, offering less opportunity to move into the most senior roles. The analysis goes on to consider a number of obstacles that women face at mid-management levels and suggest various policy initiatives that could lead to further progress.

Giles Keating, Deputy Global CIO, Private Banking & Wealth Management, said: “The CS 3000 gives compelling evidence that gender diversity on boards and in senior management is strongly linked to higher ROE, better shareholder returns, and stronger valuations. And we show that gender diversity is improving, but still woefully low in many companies. The challenge is now to accelerate this change, and extend it to broader areas of cultural diversity.”

For a copy of the report, please vist the Credit Suisse Research Institute: Women in Business page

Credit Suisse AG is one of the world’s leading financial services providers and is part of the Credit Suisse group of companies (referred to here as ‚Credit Suisse‘). As an integrated bank, Credit Suisse is able to offer clients its expertise in the areas of private banking, investment banking and asset management from a single source. Credit Suisse provides specialist advisory services, comprehensive solutions and innovative products to companies, institutional clients and high net worth private clients worldwide, and also to retail clients in Switzerland. Credit Suisse is headquartered in Zurich and operates in over 50 countries worldwide. The group employs approximately 45,100 people. The registered shares (CSGN) of Credit Suisse’s parent company, Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York. Further information about Credit Suisse can be found at www.credit-suisse.com.

This document was produced by and the opinions expressed are those of Credit Suisse as of the date of writing and are subject to change. It has been prepared solely for information purposes and for the use of the recipient. It does not constitute an offer or an invitation by or on behalf of Credit Suisse to any person to buy or sell any security. Any reference to past performance is not necessarily a guide to the future. The information and analysis contained in this publication have been compiled or arrived at from sources believed to be reliable but Credit Suisse does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof.