The Fraud Matrix: Corruption, Asset Misappropriation and Financial Statement Fraud

Author: Dr. Michael-A. Leuthner, CPA

Fraud Part I

The first article of this series discussed the human factor in fraud and this, the second article, will describe the kinds of fraud that can be found in a business context. The third article will present a recommended procedure for companies in which a fraud has just been discovered, featuring three different scenarios based on real situations. The fourth article will describe simple, effective and easily implemented measures that can massively reduce fraud in a business environment (also known as occupational fraud).

Occupational fraud was already the subject of research in the 1950s and was described in the first article in this series.[1]

This organization credited with bringing this topic to the attention of the general public is the Association of Certified Fraud Examiners (ACFE), founded in 1988 by the US CPA and former FBI employee, Joseph Wells, Ph.D. h.c. Today this association boasts over 75,000 members worldwide and offers a special professional qualification as Certified Fraud Examiner, or CFE.[2]

Interestingly, the worldwide largest frauds took place between 1997 and 2009[3], long after this association was founded. One of the largest, the Enron fraud in the US, prompted one of the most important pieces of anti-fraud legislation, the US Sarbanes-Oxley Act of 2002. Parts of this influential law can also be found in the German Financial Reporting Modernization Law of 2009, or BilMoG. [4]

As the discussion of various kinds of occupational fraud became more detailed, it was necessary to classify the kinds of fraud by certain criteria and the classification criteria of the ACFE have prevailed in recent years.

The following chart shows the classification system of the ACFE. Variations of occupational fraud are divided into the main categories Corruption, Asset Misappropriation and Financial Statement Fraud.

Corruption is defined as the abuse of a position of trust (making or receiving bribes, offering or receiving benefits)

Asset Misappropriation is considered as the use of an asset (also money) for a purpose other than its intended purpose.

Financial Statement Fraud is the classic falsification of financial records and reports.

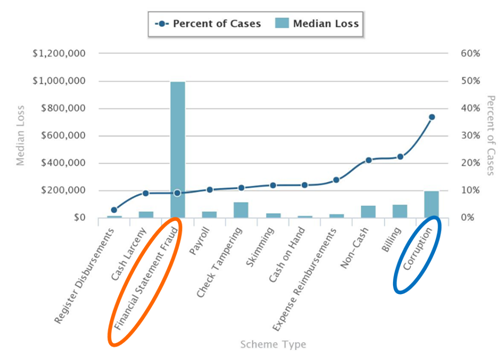

As one might imagine, the various kinds of fraud occur with varying frequency. The average value of the fraud also changes with the kind of fraud. The diagram below shows the relative frequency and median value of a fraud, based on the results of a worldwide survey by the ACFE.

Diagram 2: Analysis of occupational fraud according to the number and median value according to the 2013 ACFE survey[5]

This depiction shows that although Financial Statement Fraud has a relative frequency of less than 10%, the average loss value is about one million US dollars ($1,000,000). Corruption, by comparison, has a relative frequency of almost 40% with an average loss value of „only“ two hundred thousand dollars ($200,000).

In the meantime, global surveys by the ACFE show that on average 5% of a company’s turnover is lost to fraud.

The current trend shows this value increasing!

The next article will present a recommended procedure for companies in which a fraud has just been discovered, featuring three different scenarios based on real situations.

Stay tuned!

Dr. Michael-A. Leuthner studied mechanical engineering and economics, writing his doctorate with a professor for financial auditing. In addition, he holds the following qualifications:

- Certified Public Accountant (State of Washington)

- Certified Internal Auditor

- Certified Fraud Examiner

- Certified Financial Services Auditor

Focus of Dr. Leuthner’s work is restructuring and fraud discovery and prevention in international firms around the world.

E-mail: leuthner@cpa-leuthner.com

[1] See also the description in part one of this series.

[2] This certified knowledge, perhaps belittled (by financial auditors) in the past in Germany, is gaining recognition, especially in combination with a financial auditor exam, regardless from which country.

[3] Leuthner: Systems of Internal Control and Risk Management of G7: Analysis and Comparison of the systems of Internal Control and Risk Management between the U.S. and other G7 countries; available for example at http://www.amazon.de/

[4] Bilanzrechtmodernisierungsgesetz

[5] The online survey was available to 34,615 Certified Fraud Examiners from October to December 2013. The ACFE received 1,713 replies, of which 1,483 were valid for the analysis. It is assumed that these results are representative. http://www.acfe.com/rttn/images/cost-of-fraud-infographic.pdf