Occupational fraud: Priority on Prevention

Author: Dr. Michael-A. Leuthner

The most important component is the “tone at the top“, which means a culture of compliance with laws and regulations, combined with the mission statement of top management. A culture of compliance will only be effective if top management always acts as an example and infringements and non-compliance of rules and regulations will be punished adamantly by management.

Part IV: Fraud prevention

Following the first article of this series, which described the human factor in fraud, the second article described the different kinds of fraud that can be found in a business context. In the third article it was explained how to deal with a freshly discovered fraud in an organization and what specific steps should be taken next.

This fourth article will show which simple but highly effective measures can be taken to deter occupational fraud.

As already described in the third article, the participants of the ACFE’s[1] worldwide survey estimated that the typical organization loses about 5% of revenues in a given year as a result of fraud. So it’s in any case worth to take steps to deter fraud.

The most important component is the “tone at the top“, which means a culture of compliance with laws and regulations, combined with the mission statement of top management.

A culture of compliance will only be effective if top management always acts as an example and infringements and non-compliance of rules and regulations will be punished adamantly by management.

What about the average employee if he recognizes that his superiors show a kind of ‚laissez-faire‘-mentality and do not take e.g. the reimbursement of the T&E-expenses according to the rules seriously. Unfortunately, negative incidents circulate faster than positive ones. Senior management is therefore acting as the promotor for compliance.

Dual Control Principle

The second important component is the dual control principle (two persons are needed to authorize decisions), or called segregation of duties. Well known are its limitations, because when the second person is also a fraudster like the first, it does have its natural limits. Nevertheless, not for every process the company can use a second person for monitoring, so you will have to implement automated devices, e.g. check digits.

Effectiveness is only given when the second person will be able to fulfill the task of the non-conforming first person’s main task. Therefore one should ask himself, what is the usefulness of another crew member in the cockpit of an aircraft if the remaining second pilot has some (criminal) intentions?

The probable best strategy for the deterrence of occupational fraud will be the implementation of the dual control principle together with the tone at the top.

Let’s go to the initial detection of occupational fraud:

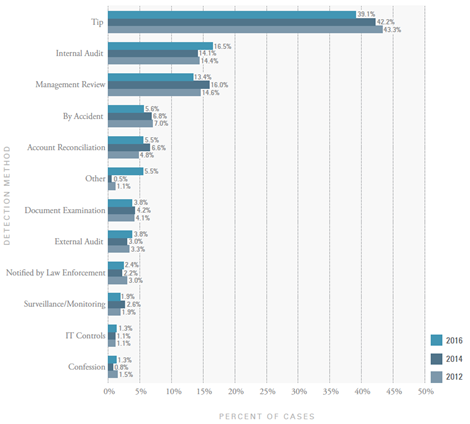

If we are analyzing the methods of initial detection of the last years concerning the overall frequency[2], the picture is nearly unchanged. The biggest number of fraud cases is detected through tips, which is far beyond the external audit, whose focus is definitely not fraud detection.

Hotlines for Employees

For receiving information about potential fraud, many companies implemented so-called ‘hotlines’ for employees’ anonymous reporting of instances of fraud, business misconduct or non-compliance. A hotline is a 24/7 manned telephone like a customer service telephone number, mostly operated by a independent third-party provider. Through experience it is known that only around 10% of the phone calls received is actual fraud.

The scope of the incoming calls ranges from ‚just trying‘ to ‘defamation of a superior’, from ‘paying back someone for something’ to ‘aggrandize oneself’. Therefore, it is very difficult for the employees working on the hotlines to scrutinize if the calls are useful and valid and what is based on facts.

Staff has to be trained well to get the feeling how to treat the callers with faith for gaining valuable information in a short period of time.

But a hotline can do much more than only giving employees a possibility to file a potential complaint of fraud. “Leveraging your hotline for more than just fraud tips can have surprising benefits”, says Janet M. McHard[3].

The caller does not only have fear, he also feels unsafe and in most of all case he or she would like to continue as an anonymous person. Otherwise the caller would not use the hotline, he would have used official channels in the company to report the incident.

It seems that treason is loved but not the traitor. From an economic point of view this is not true, because due to fraud we lose taxpayers money, which are hopefully better spent for general public interest.

Stay tuned!

Dr. Michael-A. Leuthner is a:

- Certified Public Accountant

- Certified Fraud Examiner

- Certified Internal Auditor)

- Certified Financial Services Auditor.

Email: leuthner@cpa-leuthner.com

[1] Association of Certified Fraud Examiners; www.acfe.com

[2] Report to the Nations, www.acfe.com

[3] Hotlines for Heroes, Making a Fraud Hotline Accessible and Successful, www.acfe.com